Indonesia's Islamic forces full of hate, former president Abdurrahman Wahid says

Islamic extremists have infiltrated deep into Indonesia's government, businesses, schools and religious bodies, and are using cunning new tactics to seize control of mosques and preach radicalism, former president Abdurrahman Wahid has written in a new book. Mr Wahid, who was president of Indonesia from 1999 to 2001, said hardliners were transforming Indonesia's traditionally moderate brand of Islam into one that is "aggressive, furious, intolerant and full of hate".

Writing in The Illusion of an Islamic State, Mr Wahid said the extremists were systematically infiltrating Indonesian institutions in order to remake Indonesian society "in their own harsh and rigid likeness". Mr Wahid, also known as Gus Dur, said the hardliners were strongly influenced by transnational Islamic movements from the Middle East, such as Wahhabism and the Muslim Brotherhood, and many are financed by massive amounts of Wahhabi petro-dollars.

The 68-year-old wrote that the hardliners have penetrated to the heart of Indonesia's Government, and warned of opportunistic politicians who work with extremist political parties and groups. "They have joined the extremists in driving our nation towards a deep chasm, which threatens destruction and national disintegration," he wrote.

The book is based on more than two years of research by the LibForAll Foundation, a non-government organisation set up to promote religious tolerance and discredit extremism.

The Indonesian Council of Religious Scholars had largely fallen into the grip of radicals and is now dictating to - and in many ways controlling - the country's government, he wrote. As Mr Wahid noted in the introduction, researchers for the book uncovered evidence of several cunning schemes extremists use to seize control of mosques. Under one scheme, a group of youths offer a mosque a free cleaning service. Actually "extremist agents", the cleaners aim to impress a mosque's management with their piety, and eventually gain a spot on the mosque's board. Once on the board, they consolidate their power, stack it with other radicals and eventually come to control who can serve as imam, deliver sermons or give religious education.

The groups were also involved in strenuous efforts to seize control of Indonesia's mainstream Islamic organisations, particularly Muhammadiyah and the Nahdatul Ulama, in order to use them as vehicles to spread extremism, Mr Wahid said.

About 90 per cent of Indonesia's 240 million people are Muslims. Mr Wahid, Indonesia's fourth president, was kicked out of office and impeached in 2001 amid accusations of incompetence and corruption. [That last sentence is misleading. Allegations are cheap. In fact, he was too tolerant for the Jakarta establishment so they got rid of him. He is a very devout and sincere man]

SOURCE

**********************

The folly of estate taxes

In Australia, where I live, all estate taxes were abolished long ago

President Barack Obama has proposed prolonging the federal estate tax rather than ending it in 2010, as is scheduled under current law. The president's plan would extend this year's $3.5 million exemption level and the 45% top rate. But will this really help America recover from recession and reduce our growing deficits? In order to assess the pros and cons of the estate tax, we should focus on its impact on those who bequeath wealth, not on those who receive wealth.

Advocates of the estate tax argue that such a tax will reduce the concentrations of wealth in a few families, but there is little evidence to suggest that the estate tax has much, if any, impact on the distribution of wealth. To see the silliness of using the estate tax as a tool to redistribute wealth, realize that those who die and leave estates would be taxed just as much if they bequeathed their money to poor people as they would if they left their money to rich people. If the objective were to redistribute, surely, an inheritance tax (a tax on the recipients) would make far more sense than an estate tax.

Indeed, from a societal standpoint, inheritance is an unmitigated good. Passing on to successive generations greater health, wealth and wisdom is what society in general, and America specifically, is all about. Imagine what America would look like today if our forefathers had been selfish and had left us nothing. We have all benefited greatly from a history of intergenerational American generosity. But just being an American is as much an accident of birth as being the child of wealthy parents. If you are an American, it's likely because ancestors of yours chose to become Americans and also chose to have children.

In its most basic form, it's about as silly an idea as can be imagined that America in the aggregate can increase the standards of living of future generations by taxing individual Americans for passing on higher standards of living to future generations of Americans of their choice. Clearly, taxing estates at death will induce people who wish to leave estates to future generations to leave smaller estates and to find ways to avoid estate taxes. On a conceptual level, it makes no sense to tax estates at death.

Study after study finds that the estate tax significantly reduces the size of estates and, as an added consequence, reduces the nation's capital stock and income. This common sense finding is documented ad nauseam in the 2006 U.S. Joint Economic Committee Report on the Costs and Consequences of the Federal Estate Tax. The Joint Economic Committee estimates that the estate tax has reduced the capital stock by approximately $850 billion because it reduces incentives to save and invest, has excessively high compliance costs, and results in significant economic inefficiencies.

Today in America you can take your after-tax income and go to Las Vegas and carouse, gamble, drink and smoke, and as far as our government is concerned that's just fine. But if you take that same after-tax income and leave it to your children and grandchildren, the government will tax that after-tax income one additional time at rates up to 55%. I especially like an oft-quoted line from Joseph Stiglitz and David L. Bevan, who wrote in the Greek Economic Review, "Of course, prohibitively high inheritance tax rates generate no revenue; they simply force the individual to consume his income during his lifetime." Hurray for Vegas.

If you're rich enough, however, you can hire professionals who can, for a price, show you how to avoid estate taxes. Many of the very largest estates are so tax-sheltered that the inheritances go to their beneficiaries having paid little or no taxes at all. And all the costs associated with these tax shelters and tax avoidance schemes are pure wastes for the country as a whole and exist solely to circumvent the estate tax. The estate tax in and of itself causes people to waste resources.

Again, a number of studies suggest that the costs of sheltering estates from the tax man actually are about as high as the total tax revenues collected from the estate tax. And these estimates don't even take into account lost output, employment and production resulting from perverse incentives. This makes the estate tax one of the least efficient taxes. And yet for all the hardship and expense associated with the estate tax, the total monies collected in any one year account for only about 1% of federal tax receipts.

It is important to realize that less than half of the estates that must go through the burden of complying with the paperwork and reporting requirements of the tax actually pay even a nickel of the tax. And the largest estates that actually do pay taxes generally pay lower marginal tax rates than smaller estates because of tax shelters. The inmates really are running the asylum.

In 1982, Californians overwhelmingly voted to eliminate the state's estate tax. It seems that even in the highest taxed state in the nation there are some taxes voters cannot abide. It shouldn't surprise anyone that ultra-wealthy liberal Sen. Howard Metzenbaum, supporter of the estate tax and lifetime resident of Ohio, where there is a state estate tax, chose to die as a resident of Florida, where there is no state estate tax. Differential state estate-tax rates incentivize people to move from state to state. Global estate tax rates do the same thing, only the moves are from country to country. In 2005 the U.S., at a 47% marginal tax rate, had the third highest estate tax rate of the 50 countries covered in a 2005 report by Price Waterhouse Coopers, LLP. A full 26 countries had no "Inheritance/Death" tax rate at all.

In the summary of its 2006 report, the Joint Economic Committee wrote, "The detrimental effects of the estate tax are grossly disproportionate to the modest amount federal revenues it raises (if it raises any net revenue at all)." Even economists in favor of the estate tax concede that its current structure does not work. Henry Aaron and Alicia Munnell concluded, "In short, the estate and gift taxes in the United States have failed to achieve their intended purposes. They raise little revenue. They impose large excess burdens. They are unfair."

For all of these reasons, the estate tax needs to go, along with the step-up basis at death of capital gains (which values an asset not at the purchase price but at the price at the buyer's death). On purely a static basis, the Joint Tax Committee estimates that over the period 2011 through 2015, the static revenue losses from eliminating the estate tax would be $281 billion, while the additional capital gains tax receipts from repeal of the step-up basis would be $293 billion.

SOURCE

********************

ELSEWHERE

CO: Jury awards $1 to corrupt Ward Churchill: “A jury Thursday found that former college professor Ward Churchill, who referred to victims of the September 11, 2001, attacks as ‘little Eichmanns’ in an essay, was wrongfully terminated by the University of Colorado, according to a court official. But the jury, which deliberated for a day and a half after a trial that began March 9, awarded Churchill only $1, the minimum they could award while still finding in Churchill’s favor, according to Robert McCallum, pubic information officer for Colorado’s 2nd Judicial District Court. … Churchill argued during the trial that he was fired from his tenured position for expressing politically unpopular, but constitutionally protected, views. The university argued in the trial that he was not fired for his political views but rather for sloppy academic work.”

The mark-to-market relief rally: “The events leading to the Dow’s climbing over 8000 today can be properly called the Mark-to-Market Relief Rally. More than any expected action of the bureaucrats and politicians at the G20, the decision today of the Financial Accounting Standards Board (FASB) to relax strict application of mark-to-market accounting mandates, urged on by members of Congress of both parties, it what’s giving investors something to cheer for.”

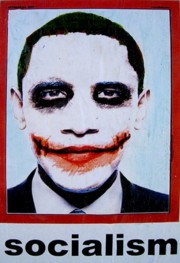

Obama: The hollow man: “Normally, I try not to think too much about presidents. The mainstream media focus excessively on them, cheapening the quality of political discourse. As a result, American citizens who are inclined to talk about politics regurgitate pointless trivia about the White House occupant and staff — things they’ve heard on National Public Radio or seen on TV. But we have a new occupant in the White House, one whom the popular media laud as a visionary and transformative figure. To anyone who loves liberty, this overwrought praise is by itself a cause for skepticism. And skepticism is surely warranted, on many grounds.”

A caricature of a riot: “Yesterday’s anti-capitalist protest in London was a half-hearted ritual of pretend-rage and pseudo-concern. ‘Concerned of Tunbridge Wells’ was elbowed aside by ‘Angry of Brighton’ in a shallow display of second-hand militancy. What was really striking about the G20-related demonstrations against ‘capitalism and climate chaos’ — which took place outside the Bank of England and elsewhere in London — was the extent to which the opportunistic coalition of protesting moral crusaders represented a going-through-the-motions activism; they weren’t so much representing a cause as searching for one. Predictably, the authorities faithfully played their part in this melodrama.”

Obama’s losing bet on Detroit : “If you had bought $1,000 worth of General Motors stock in 2000, your holdings would now be worth less than $40, for a loss of 96 percent. You could have made worse investments in that period — with Bernard Madoff, for one — but not many. So anyone looking to participate in a viable business would look a lot of other places before they would look there. But the United States government thinks GM might just be a really smart place to put its money.”

For more postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, GUN WATCH, SOCIALIZED MEDICINE, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS, IMMIGRATION WATCH INTERNATIONAL, EYE ON BRITAIN and Paralipomena

List of backup or "mirror" sites here or here -- for readers in China or for everyone when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here or here or here

****************************

The Big Lie of the late 20th century was that Nazism was Rightist. It was in fact typical of the Leftism of its day. It was only to the Right of Stalin's Communism. The very word "Nazi" is a German abbreviation for "National Socialist" (Nationalsozialist) and the full name of Hitler's political party (translated) was "The National Socialist German Workers' Party" (In German: Nationalsozialistische Deutsche Arbeiterpartei)

****************************

Saturday, April 04, 2009

Subscribe to:

Post Comments (Atom)

It's the shared hatred of the rest of us that unites Islamists and the Left.

It's the shared hatred of the rest of us that unites Islamists and the Left.

No comments:

Post a Comment