Was "Ricci" really a victory?

Or was it a "no win" for employers? It may mean that there is no test at all for the competence of your local firefighters. Too bad if your building burns down because the firefighters don't know how to use their equipment properly or deal with the problem in the best way

In 2004, the City of New Haven, Connecticut, decided to throw out a job-related examination that would have qualified Frank Ricci and 17 other firefighters for promotions. Neither Ricci nor his cohorts, all eligible for promotion based on the exam results, were black. This greatly displeased the Reverend Boise Kimber, a local "community leader" who had threatened to incite race riots in the past. Given that Kimber reliably delivered a key bloc of votes to the city's longtime mayor, John DeStefano, it's hardly surprising that the mayor and his advisors immediately began working to have the test results set aside.

In Ricci v. DeStefano, its most anticipated decision of the term, the U.S. Supreme Court handed down a 5-4 decision recognizing that Ricci and his fellow firefighters were victims of race discrimination under Title VII of the Civil Rights Act. (In so doing, the Court reversed an appeals court ruling joined by Judge Sonia Sotomayor, President Obama's nominee to replace retiring justice David Souter.) The Court rejected New Haven's claim that had it not invalidated the test, black firefighters would have had a valid lawsuit under the Civil Rights Act's "disparate-impact" provision, which holds employers at least presumptively liable any time the racial composition of employees hired or promoted differs markedly from the pool of applicants.

While the Supreme Court's decision won relief for the sympathetic Ricci--a dyslexic who sacrificed financially to spend extra time preparing for the exam--and the majority's reading of the Civil Rights Act and its amendments is probably correct, the case highlights the bankruptcy of modern American antidiscrimination law. The ruling effectively assures that employers, both public and private, will be sued for using any neutral employment test unless all races score more or less equally on the test. The employer is caught between the proverbial rock and a hard place: if it jettisons the test, it will be sued by plaintiffs like Ricci; if it uses the test, it will be sued by members of the underperforming racial group.

That the Court's opinion found that black firefighters would not have had a plausible case against New Haven offers employers little solace. In reaching its conclusion, the Court merely determined that there was not a "strong basis in evidence" for such a claim in this case. But before any court could make such a finding in a future case, the lawyers would have to build a factual record, since the law continues to presume that racial disparities in hiring result from discrimination. Thus, no employer that adopts an employment criterion that produces a disparate racial impact can avoid depositions, discovery, motions, and the host of onerous and expensive pretrial rituals endemic to modern litigation. Moreover, because any disputed facts would require a jury's resolution, most cases would be impossible for a judge to resolve without taking them to trial.

At root, the problem rests with disparate-impact law itself. There is little reason to think that all racial subgroups should be equally prepared for any job or promotion. Consider that white players constitute 40 percent of NCAA Division I basketball rosters, but only two of the 25 collegians drafted in last week's NBA draft. It would be preposterous to assume based on such numbers that NBA franchises' decisions were racially discriminatory. It would be even sillier to subject to judicial inquiry the various job-related skills tests the NBA imposed at the draft combines--including vertical leaps and shuttle runs--and ask whether alternative tests might be equally effective and less likely to exclude prospective white players. But such inquiries are very much what the antidiscrimination laws impose on employers in hosts of other contexts, including that of New Haven's firefighters' exam.

I am hardly qualified to know whether the New Haven Fire Department chose the best possible test for assessing prospective supervisors. But I can predict that rational employers will react to Ricci by dropping such exams whenever possible, in effect capitulating to the racial bean-counters. Such an outcome is disconcerting, at least for those who believe that firefighter supervisors should have some requisite body of knowledge before sending public servants into burning buildings.

To head off this undesirable result, Congress should undo its 1991 decision to codify the disparate-impact test into the Civil Rights Act. There are cases in which it makes sense for antidiscrimination law to look beyond an employer's intent. For example, strict seniority standards for promotion--even if adopted without discriminatory motive--are hard to defend when such seniority has itself been predicated upon an employer's past discrimination. But plenty of plausible rules would capture such cases apart from a lawsuit-provoking presumption that racial discrimination accounts for any racial imbalances. Ironically, while the disparate-impact rule requires courts to reject employer tests if any alternative might suffice, it fails to meet such a high standard itself. It won't happen in this Congress, but ultimately, let's hope that disparate impact finds itself in the dustbin of history.

SOURCE

*************************

America's Socialist Past

The perennial illusion

There seems to be a need in American society to have to relearn the same hard lessons over and over again, regardless of whether the results were seen on the other side of the planet or suffered through by our own people.

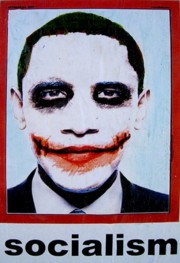

We're living in a country that elected a President that believes in redistributing wealth. He's mentioned this himself, from the "Joe the Plumber" incident[i] to his critique[ii] of the failures of the civil rights movement. Whether you call it Socialism, Communism, Marxism, or by its simpler name, theft, they are all part of the same economic system that destroys private property and puts everything in central control of the state.

The lesson we, and the rest of the world, seems to fail to learn is how socially and economically destructive this sort of system is. The problem is, these lessons don't have to be learned from studying the histories of far off lands, for we have numerous examples of collectivist/socialist experiments here at home.

In Jamestown, there was no welfare state. Originally meant to be a trading colony, too many of the original inhabitants were adventurers or people seeking to gain wealth through the export of things they could find in the new world. Preoccupied with their own ideas of fortune, they found that in the wilderness of what was North America their habit of avoiding physical labor meant life or death. It was here that John Smith proclaimed, "He who will not work will not eat."[iii] It worked...sort of. While success still eluded the colony, the mortality rate did go from 60 percent to 15 percent.

Imagine a politician on any level making Smith's proclamation today. Cities would burn. Of course, when Sir Thomas Dale arrived there in 1611, he saw "where the most company were, and the daily and usual workers, bowling in the streets."[iv] Apparently Smith's proclamation had only motivated the people enough to do the minimum. Sir Dale had to motivate the people to fix up their houses, plant corn, and secure the defenses of the fort.

Lord De La Warr, the first official governor of Jamestown, continued with the communal storehouse practice. This meant that no matter how hard one worked; everyone was entitled to food so nobody would (in theory) starve. It only prolonged the hardship. Seeking a way around this, the administrators began using the incentive approach (as opposed to Smith's harsh approach) and privatized land ownership. With tobacco finding a market back in Europe, the private property incentives mixed with trading allowed Jamestown to finally get over the hump and begin to prosper.[v]

The Pilgrims sought to live in a society that promoted "just and equal laws." Their first year saw the death of half of their population through disease, starvation, and malnutrition (again, thanks to communal farming). In a story that's getting more and more circulation in today's internet age (and thanks to Rush's yearly reading of the story of Thanksgiving), we learn that only when William Bradford instituted private property that people began to work harder and innovate more.[vi] Even women and children went out to the fields with their husbands, which meant more crops were planted and ultimately harvested. This led to more trade with the local tribes, earlier repayment of debt to the English sponsors, and overall prosperity of the colony.

Let's fast forward a bit.

The date is January 1, 1816, and a man named Robert Owen proposed a new type of model society. In his plans, each of these communities of 2,500 individuals would "be self-governing and hold its property in the common."[vii] So popular was Owen that when he reached America from Britain, President John Quincy Adams displayed one of Owen's architectural models for this ideal community. He established his community in Indiana, christening it New Haven in 1825. In New Haven, "not only work, but also recreation and meditation were communal and regimented."[viii] Everything was collectivized, including "cooking, child care, and other domestic work."[ix] Ironically, at least by today's "Liberal" standards, it was women that were relegated to these chores. The community lasted two years.

The term "socialism" was actually coined by Owen's followers around the time New Haven failed.

Eighteen other communities were established on the Owen collectivized model across the United States. Modern Times, the name of the community established on Long Island, was the last to fail. This was in 1863.

Charles Fourier, a French social theorist, came up with the solution to the problems associated with collectivized living: It should be done on a smaller scale. He calculated that 1,620 was the ideal population and that they should live on 6,000 acres. These were called phalanxes. In the 1840's, a man named Charles Brisbane decided to implement this idea, ultimately establishing 28 of them. All failed within 12 years.[x]

In 1804, George Rapp and six hundred of his followers came to America. They set up a community in Pennsylvania called Harmony where communal farming was practiced, but they were expecting the second coming and left for Indiana in 1814 before it could be deemed a success or failure. While in Indiana, they established another community and named it (again) Harmony, but sold it ten years later to Robert Owen (who set up New Harmony there) and moved back to Pennsylvania. These people began the petroleum industry in Pennsylvania (a move to capitalism), but eventually died out due to their celibacy and lack of recruits.[xi]

In 1841, Humphrey Noyes started the "Perfectionists", and wrote a book on his theories titled Bible Communism in 1848. Noyes took collectivism to the next level; not only was all property communal, but so were spouses. The term for this was "complex marriage" and in practice it meant, "all the men in the Perfectionist community considered themselves husbands to all the women, and each woman the wife of every man."[xii] Before coitus, and even conception, people had to have consent granted by the whole community. Economically, and with a hint of irony, they flourished by building and marketing animal traps. However, this particular communist experiment ended when they established a joint-stock company called Oneida Community, Ltd.

In showing what a great social and economic model Communism is, Harrison Berry likened it to slavery by stating in a that "a Southern farm is the beau ideal of Communism; it is a joint concern, in which the slave consumes more than the master...and is far happier, because although the concern may fail, he is always sure of support."[xiii]

George Fitzhugh, an influence on Berry, actually argued that slave labor was preferable because the slaves were ultimately free. It was property owners and free laborers that were the slaves. He advocated that taking decision-making out of the hands of individuals made the African slaves better off than free whites and claimed that not only all blacks, but most whites too, should be slaves.[xiv] His theory was ultimately squashed with the support and ratification of the 13th and 14th Amendments, which not only freed the slaves but also established they had constitutionally protected private property rights.

These few examples, and there are more out there, show how American culture even before the Civil War (or the War of Northern Aggression, depending on your location) tried communal living and centrally planned economic models. Despite the good intentions of the people involved, they always fail because of the inherent flaws in Socialism. Unfortunately, given the reach of the federal government and current make-up of the executive and legislative branches, we are set to learn this lesson the hard way. Again.

SOURCE

***********************

ELSEWHERE

Misplaced faith: “Those of us viewing the world with knowledge of Austrian Economics are watching the inevitable result of allowing politicians to print money without limit. The dramatically more popular Keynesian theorists who dominate government economic posts spew lots of comforting words that continue to prove wrong. Yet those of us trying to get friends and family to prepare for economic collapse are greeted with patient, ‘They have a lot of smart guys who know what they are doing.’ I know the discussion is over and am saddened by the tragic three assumptions embedded in their sense of security: that the manipulators are honest, knowledgeable and that they have our best interests at heart.”

Swiss banks shun American investors : "Swiss banks are shutting the accounts of Americans as the U.S. Internal Revenue Service accelerates the hunt for tax dodgers. UBS AG and Credit Suisse Group AG, the country’s biggest banks, have told Americans to move their money into specially created units registered in the U.S., or lose their accounts. Smaller private banks such as Geneva-based Mirabaud & Cie. are closing all accounts held by U.S. taxpayers. While the banks declined to say how many people are affected, more than 5 million Americans live abroad, including about 30,000 in Switzerland, according to estimates from American Citizens Abroad in Geneva. Swiss banks must register with the Securities and Exchange Commission to provide services for those customers.” [British banks are closing the accounts of Americans too. The Federal paperwork required makes it too burdensome to have American customers]

Nice to have friends in high places: "Sen. Daniel K. Inouye's staff contacted federal regulators last fall to ask about the bailout application of an ailing Hawaii bank that he had helped to establish and where he has invested the bulk of his personal wealth. The bank, Central Pacific Financial, was an unlikely candidate for a program designed by the Treasury Department to bolster healthy banks. The firm's losses were depleting its capital reserves. Its primary regulator, the Federal Deposit Insurance Corp., already had decided that it didn't meet the criteria for receiving a favorable recommendation and had forwarded the application to a council that reviewed marginal cases, according to agency documents. Two weeks after the inquiry from Inouye's office, Central Pacific announced that the Treasury would inject $135 million."

Crooked ACORN to be investigated: "The Association of Community Organizations for Reform Now, the multi-level activist organization for which President Obama worked and which now is entangled in charges of voter fraud in multiple jurisdictions across the U.S., appears to be in the bull's-eye of investigators. According to the Pittsburgh Tribune-Review, a judge hearing a voter fraud case against an ACORN employee has suggested investigators pursue the conglomerate itself, obtaining a promise that it will be done. The exchange came in the courtroom of Senior District Judge Richard Zoller. The Tribune-Review report today said the judge told Allegheny County Detective Robert F. Keenan, "Somebody has to go after ACORN. … It's happening all over the country. All you have to do is turn on the television." Keenan responded, "We will." The local investigation into members of ACORN and their allegedly illegal voter registration actions last year remains "open and active," a spokesman for District Attorney Stephen Zappala Jr. told the newspaper. "There is quite a bit of activity aimed at determining if anyone else should be charged," said Mike Manko."

Inflation deception: "I usually have a get “prepared” to visit John Williams at his famous shadowstats.com site so that I am “feeling no pain,” and this time I was happy I was, as his headline was “Inflation, Money Supply, GDP, Unemployment and the Dollar – Alternate Data Series”. As for inflation, his calculation of the Consumer Price Index “reflects the CPI as if it were calculated using the methodologies in place in 1980”, which I note is back when inflation was a measurement of the change in prices of things that you buy, and not, as it is now after the villainous Alan Greenspan and Michael Boskin came up with their ludicrous “hedonic” measurements of inflation with which to disguise it. Anyway, Mr. Williams’ honorable and time-honored methodology shows inflation in prices running about 6%, which is a horrendous rate, which is a big shock to those who have just swallowed the government’s estimate of CPI as being a negative 1.3% over the last year!

Bloodless instability: “Your average politician will often rail against ‘political instability’ and advocate policies to keep things ’stable,’ such as subsidies, bailouts, quotas, and other forms of protectionism. But while stability certainly sounds like something positive for the economy, Joseph Schumpeter argued very persuasively that it was the ‘creative destruction’ of capitalism that facilitated innovation, and further down the line, economic growth. Simply reframe the ’stability vs. instability’ dilemma as ’scleroticism vs. dynamism,’ and Schumpeter’s logic becomes all the more easy to grasp. But what of government? While dynamism in the economy is something to be desired, dynamism in sovereignty has some obvious drawbacks. One is that transitions between sovereigns are rarely bloodless, and dead bodies littered all over the streets are hardly a boon to commerce. Another is that in the process of any conflict, capital is bound to be destroyed, so the economy will be handicapped massively. But on this last point, the data simply doesn’t work out the way you might think.”

My Twitter.com identity: jonjayray. For more blog postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, GUN WATCH, SOCIALIZED MEDICINE, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS, IMMIGRATION WATCH INTERNATIONAL, EYE ON BRITAIN and Paralipomena

List of backup or "mirror" sites here or here -- for readers in China or for everyone when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here or here or here

****************************

The Big Lie of the late 20th century was that Nazism was Rightist. It was in fact typical of the Leftism of its day. It was only to the Right of Stalin's Communism. The very word "Nazi" is a German abbreviation for "National Socialist" (Nationalsozialist) and the full name of Hitler's political party (translated) was "The National Socialist German Workers' Party" (In German: Nationalsozialistische Deutsche Arbeiterpartei)

****************************

Friday, July 03, 2009

Subscribe to:

Post Comments (Atom)

It's the shared hatred of the rest of us that unites Islamists and the Left.

It's the shared hatred of the rest of us that unites Islamists and the Left.

Eugenio Pacelli, a righteous Gentile, a true man of God and a brilliant Pope

Eugenio Pacelli, a righteous Gentile, a true man of God and a brilliant Pope

No comments:

Post a Comment