It's almost impossible to open a newspaper these days without being reminded that inequality has grown in recent decades. The reactions to the stated rise do vary, that is true: from it being an unfortunate side effect of growth or globalisation in general to proof positive that we'll all be murdered in our beds when the rabble realise how badly they're being treated.

Will Wilkinson at Cato has a paper out which covers much of the extended conversation and I think's he's right in that inequality simply hasn't grown as much as some say: "To put if more breezily, if cheap stuff gets better faster than expensive stuff, the gap between cheap and expensive stuff narrows, which in turn narrows the gap in the quality of life between rich and poor."

There's a great deal to this: as he says, there's a difference between an expensive car and a cheap one but that gap is as nothing to the one between having a car and using Shank's Pony. Or between an expensive fridge, a cheap one and none.

It's very definitely true that income inequality has risen in recent decades: but much much harder to insist that consumption inequality has done. As an example, there are certainly differences in diet between the rich and the poor in the UK: but it's only in the last 50 years or so that all, of whatever station in life, are financially able to eat a full and balanced diet. We no longer have the height inequality we did (reflecting again nutrition, where the rich were substantially taller than the poor), nor the health care inequality and while education is rightly a bone of contention we've certainly advanced from the medieval idea that only the male rich or the clergy might be literate or numerate.

What makes this oversight from certain on the left so puzzling is that they are exactly the people who have been telling us for years that there is much more to life than simply grabbing for the filthy lucre. That health, enjoyment, leisure are also important, perhaps more so than money. Anyone with an adult and rounded view of life would have to agree with that sentiment, that there's more to it all than simply pilng up the pounds. Which makes it all the more puzzling that there is so much vituperation over inequality rising in that most trivial of things, mere cash, while all the other historically extant inequalites have been shrinking.

SOURCE

*********************

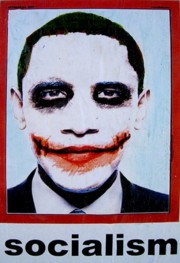

Obama is a hollow shell compared to the Gipper

By Ron Miller

I have been critical of President Obama's overseas pronouncements apologizing for America, equating our failings to some of the world's most egregious offenses against humanity, and excusing the atrocities of terrorists and dictators as byproducts of America's sins in world affairs.

If he's trying to curry favor in the international community with his equivocation and expressions of shame, he's naive. If he truly believes what he's saying, then I am appalled at his contempt for the nation that elected him to the most powerful position in the world.

His recent statements in Moscow disavowing America's pivotal role in ending the Cold War frustrated me because while he was organizing communities and pursuing his law degree, I was engaged in helping my country fight that war.

I was an intelligence officer in the U.S. Air Force from 1983 to 1992. I reviewed and analyzed our most sensitive intelligence information and briefed senior commanders on the militaristic and murderous actions of the Soviet Union and the Warsaw Pact.

When Ronald Reagan went against the advice of the State Department and his advisors and declared the Soviet Union "an evil empire," he was condemned by many but I cheered his words because they rang with the authority and clarity of truth. And I wasn't the only one.

Natan Sharansky, the Soviet dissident and human rights activist, was in a Soviet gulag serving 13 years of forced labor when Ronald Reagan uttered those words. While the voices of appeasement in the United States and the West cried out against the provocative words of our "cowboy" President, the reaction in the gulag was markedly different:

"It was the great brilliant moment when we learned that Ronald Reagan had proclaimed the Soviet Union an Evil Empire before the entire world. There was a long list of all the Western leaders who had lined up to condemn the evil Reagan for daring to call the great Soviet Union an evil empire right next to the front-page story about this dangerous, terrible man who wanted to take the world back to the dark days of the Cold War. This was the moment. It was the brightest, most glorious day. Finally a spade had been called a spade. Finally, Orwell's Newspeak was dead. President Reagan had from that moment made it impossible for anyone in the West to continue closing their eyes to the real nature of the Soviet Union.

"It was one of the most important, freedom-affirming declarations, and we all instantly knew it. For us, that was the moment that really marked the end for them, and the beginning for us. The lie had been exposed and could never, ever be untold now. This was the end of Lenin's "Great October Bolshevik Revolution" and the beginning of a new revolution, a freedom revolution--Reagan's Revolution.

"We were all in and out of punishment cells so often--me more than most--that we developed our own tapping language to communicate with each other between the walls. A secret code. We had to develop new communication methods to pass on this great, impossible news. We even used the toilets to tap on."

When Sharansky was asked if Ronald Reagan was responsible for the collapse of the Soviet Union, he said simply, "yes." He went on to say:

"Ronald Reagan had both moral clarity and courage. He had the moral clarity to understand the truth, and the courage both to speak the truth and to do what needed to be done to support it. There was more to Reagan than rhetoric...

"Reagan's great strength was his optimistic faith in freedom and that every human being deserved freedom and that this freedom is a force that can liberate and empower and enrich and ennoble...

"Thanks to Ronald Reagan, to the legacy he leaves behind, we now know that totalitarianism can be beaten and that freedom can come to anyone who wants it."

Powerful words from a man who experienced the evil of the Soviet Union personally and understood the impact of Ronald Reagan's words and deeds in bringing an end to the regime that murdered over 53 million men, women and children beginning with the barbarism of Vladimir Lenin in 1917.

Maybe it's more important to President Obama to be "a fellow citizen of the world" as he proclaimed in Berlin during the campaign.

As Newt Gingrich says, however, "I am not a citizen of the world; I am a citizen of the United States of America." Despite her struggles and failures, America has never stopped striving toward a more perfect union. I have always been proud of my country, and I ask our President to give her the credit she deserves for tearing down that wall

SOURCE

***************************

Destroying Jobs in Order to Save Them

Obama's corporate tax "reforms" make a bad situation worse

President Barack Obama is very insistent on the need to “save American jobs.” The spending and the Buy American provisions of his massive stimulus package, approved by Congress in February, were meant to “create or save” millions of U.S. jobs. “Saving jobs” was also the stated goal of his recent pledge to eliminate tax advantages for companies that do business overseas. But instead of saving American jobs, Obama’s new corporate tax is apt to worsen what is already the highest unemployment since 1983 and make America’s companies even less competitive in the global marketplace.

Last spring, partly in response to the anti-bailout tea parties that were sweeping through the country on and around the April 15 tax deadline, the president announced that he plans to simplify the tax code. That sounds like a worthwhile goal, but it turns out that forObama, simplification means taxing previously untaxed income.

For instance, the proposal targets what executives consider to be a lifesaving feature of an otherwise depressing corporate tax code: permission to indefinitely defer paying U.S. taxes on income earned overseas. According to the Obama administration, this practice keeps $700 billion or more of American corporate earnings in overseas accounts, beyond the taxman’s reach.

The president also wants to overhaul what he describes as a “much-abused” set of tax regulations known as the “check-the-box” rules. These regulations give companies some latitude in deciding where their subsidiaries will be taxed and make it easier for multinationals to transfer money between countries. The result, which Obama frowns upon, is that many companies have placed their offshore subsidiaries in low-tax countries.

While he’s at it, the president wants to restrict tax credits that the U.S. grants companies to offset taxes they pay to foreign governments.

Until now, Obama said when unveiling his plan in May, we’ve suffered under “a tax code that says you should pay lower taxes if you create a job in Bangalore, India, than if you create one in Buffalo, New York.” This notion is wrong in several ways.

It is a mistake to assume that U.S. domestic firms and U.S. multinationals are primary competitors, engaged in a zero-sum struggle. In fact, the true competitors of U.S-based firms with international operations are mainly foreign-based companies. And in that competition, the existing U.S. corporate tax code puts American firms at a clear disadvantage—one for which the alleged tax loopholes were intended to compensate.

The U.S. corporate tax rate is simply too high. When you add state corporate taxes to the 35 percent federal rate, you arrive at a whopping 40 percent average corporate tax burden, the second highest among the 30 countries in the Organization for Economic Cooperation and Development (OECD).

Economists are in broad agreement that cutting the corporate rate is a national priority. In a 2002 study, American Enterprise Institute economists Kevin Hassett and Eric Engen argued that the most efficient corporate tax rate is zero. The mobility of capital income means that even a small amount of tax introduces large distortions into an economy as capital flies away to a lower tax environment. More interesting, if counterintuitive, is the fact that because of capital mobility the people who stand to benefit most from a corporate tax cut are workers. In a 2006 study, the economist William C. Randolph of the Congressional Budget Office concluded that “domestic labor bears slightly more than 70 percent of the burden” imposed by corporate taxes.

More HERE

*************************

ELSEWHERE

It's now been 40 years since Ted Kennedy left Mary Jo Kopechne to her death. Jeff Jacoby describes the infamous behaviour that Kennedy got away with. Powerline also has some good comments. The People's Cube also has some relevant cartoons -- for those with strong stomachs.

Analysis: States hit hardest get least $timulus: "The stimulus bill ‘includes help for those hardest hit by our economic crisis,’ President Obama promised when he signed the bill into law on Feb. 17. ‘As a whole, this plan will help poor and working Americans.’ But FOXNews.com has analyzed data tracking how the stimulus money is being given out across the 50 states and the District of Columbia, and it has found a perverse pattern: the states hardest hit by the recession received the least money. States with higher bankruptcy, foreclosure and unemployment rates got less money. And higher income states received more.”

The myth that women do not perpetrate “domestic violence” : "Am I the only one who is disturbed by the double-standard that permeates the media coverage of Steve McNair’s shooting death? On July 4 the former NFL star was killed by girlfriend Sahel Kazemi. McNair was shot as he lay asleep on his couch, first in the left temple, twice in the chest, and finally in his right temple. So why are the news media stubbornly refusing to put the words ‘Steve McNair’ and ‘domestic violence’ in the same sentence? And where are all the hand-wringers who reflexively shriek we need to break the shroud of silence that surrounds partner abuse?”

Bibi flatly rejects US demand to halt housing project: "Jerusalem is the "unified capital of Israel and the capital of the Jewish people, and sovereignty over it is indisputable," Prime Minister Binyamin Netanyahu said Sunday, responding to an American demand to put an end to a housing project to be built in east Jerusalem. "Hundreds of apartments in the west of the city were purchased by Arabs and we didn't get involved. There is no prohibition against Arab residents buying apartments in the west of the city and there is no prohibition barring the city's Jewish residents from buying or building in the east of the city," Netanyahu added at the weekly cabinet meeting. "That is the policy of an open city that is not divided. "We cannot accept the notion that Jews will not have the right to buy apartments specifically in Jerusalem. I can only imagine what would happen if they were forbidden from purchasing apartments in New York or London; there would be an international outcry. This has always been Israel's policy and this is the policy of the current government," the prime minister added. Netanyahu's remarks came after Ambassador to Washington Michael Oren was summoned to the US State Department over the week-end and was told that the Obama administration wanted Israel to put an end to construction work at the site of the historic Shepherd's Hotel in the east Jerusalem neighborhood of Sheikh Jarrah."

Europe Thumps U.S., Again. First lower taxes, now freer trade: "On present trends, most of Europe will soon have lower income tax rates than most of America. And now the European Union is stealing another competitive march on Washington, this time on a free trade deal with the world's 13th largest economy, fast-growing South Korea. Last week Brussels and Seoul finished the outline of a new trade agreement, and the two sides will now write up the technical language to codify it. As for the pending U.S.-Korea trade agreement, Congress has done . . . nothing. South Korea has made negotiating trade deals a centerpiece of its foreign and economic policy. The U.S. FTA, signed in 2007 but still not ratified, is one example. Negotiations are planned or under way with a long list of countries, including India, Canada and Australia. On the EU side, the Commission is vigorously defending the pact against domestic critics, including the European auto industry. EU approval isn't a sure thing, but Swedish Prime Minister Fredrik Reinfeldt is aiming to finish it by December. Compare that to the U.S., where the FTA with Korea is bogged down in Big Labor politics".

I guess I'm missing something but we see here that the Obama regime is paying over a million dollars for 2lb of ham. Defence contractors eat your heart out! (H/T Charlie Foxtrot)

My Twitter.com identity: jonjayray. My Facebook page is also accessible as jonjayray (http://www.facebook.com/jonjayray in full). For more blog postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, GUN WATCH, SOCIALIZED MEDICINE, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS, IMMIGRATION WATCH INTERNATIONAL, EYE ON BRITAIN and Paralipomena

List of backup or "mirror" sites here or here -- for readers in China or for everyone when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here or here or here

****************************

The Big Lie of the late 20th century was that Nazism was Rightist. It was in fact typical of the Leftism of its day. It was only to the Right of Stalin's Communism. The very word "Nazi" is a German abbreviation for "National Socialist" (Nationalsozialist) and the full name of Hitler's political party (translated) was "The National Socialist German Workers' Party" (In German: Nationalsozialistische Deutsche Arbeiterpartei)

****************************

It's the shared hatred of the rest of us that unites Islamists and the Left.

It's the shared hatred of the rest of us that unites Islamists and the Left.

Eugenio Pacelli, a righteous Gentile, a true man of God and a brilliant Pope

Eugenio Pacelli, a righteous Gentile, a true man of God and a brilliant Pope

No comments:

Post a Comment