The Goebbels of IQ research?

I have just been re-reading the Rushton & Jensen reply to Nisbett and am struck by something remarkable: Not only does Nisbett misrepresent a whole range of research but he even misrepresents research by Rushton. Rushton is a major figure in IQ research, not because of the popularity of his conclusions but because of the rigor and quality of his research and thinking. And the fact that Nisbett refers quite a bit to Rushton is a testament to that.

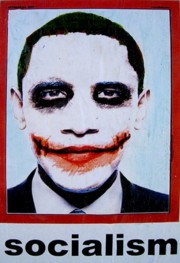

But surely Nisbett must have known that Rushton would see the misrepresentation of his research and correct Nisbett's claims about it? But Nisbett apparently didn't care about that. He seems to have figured that Rushton's voice in protest would be a small and almost inaudible squeak compared to the megaphone that the media would hand him. In other words, he was confident that the media would enable him to get across a big lie. He believed that if you tell a big enough lie often enough people will believe it -- which was also the view of Dr Goebbels, Hitler's propaganda minister.

It's reminiscent of that old neo-Marxist fraud, Stephen J. Gould, whose book The mismeasure of man still gets quoted quite a lot by Leftists despite having been comprehensively demolished many year ago. See here and here and here and here.

***********************

An Easily Understandable Explanation of Derivative Markets:

Heidi is the proprietor of a bar in Detroit. She realizes that virtually all of her customers are unemployed alcoholics and, as such, can no longer afford to patronize her bar. To solve this problem, she comes up with new marketing plan that allows her customers to drink now, but pay later.

She keeps track of the drinks consumed on a ledger (thereby granting the customers loans). Word gets around about Heidi's "drink now, pay later" marketing strategy and, as a result, increasing numbers of customers flood into Heidi's bar. Soon she has the largest sales volume for any bar in Detroit.

By providing her customers' freedom from immediate payment demands, Heidi gets no resistance when, at regular intervals, she substantially increases her prices for wine and beer, the most consumed beverages. Consequently, Heidi's gross sales volume increases massively.

A young and dynamic vice-president at the local bank recognizes that these customer debts constitute valuable future assets and increases Heidi's borrowing limit. He sees no reason for any undue concern, since he has the debts of the unemployed alcoholics as collateral.

At the bank's corporate headquarters, expert traders transform these customer loans into DRINKBONDS, ALKIBONDS and PUKEBONDS. These securities are then bundled and traded on international security markets. Naive investors don't really understand that the securities being sold to them as AAA secured bonds are really the debts of unemployed alcoholics.

Nevertheless, the bond prices continuously climb, and the securities soon become the hottest-selling items for some of the nation's leading brokerage houses.

One day, even though the bond prices are still climbing, a risk manager at the original local bank decides that the time has come to demand payment on the debts incurred by the drinkers at Heidi's bar. He so informs Heidi.

Heidi then demands payment from her alcoholic patrons, but being unemployed alcoholics they cannot pay back their drinking debts. Since, Heidi cannot fulfill her loan obligations she is forced into bankruptcy. The bar closes and the eleven employees lose their jobs.

Overnight, DRINKBONDS, ALKIBONDS and PUKEBONDS drop in price by 90%. The collapsed bond asset value destroys the banks liquidity and prevents it from issuing new loans, thus freezing credit and economic activity in the community.

The suppliers of Heidi's bar had granted her generous payment extensions and had invested their firms' pension funds in the various BOND securities. They find they are now faced with having to write off her bad debt and with losing over 90% of the presumed value of the bonds. Her wine supplier also claims bankruptcy, closing the doors on a family business that had endured for three generations, her beer supplier is taken over by a competitor, who immediately closes the local plant and lays off 150 workers.

Fortunately though, the bank, the brokerage houses and their respective executives are saved and bailed out by a multi-billion dollar no-strings attached cash infusion from the Government. The funds required for this bailout are obtained by new taxes levied on employed, middle-class, non-drinkers.

Now, do you understand?

*********************

Stimulating Ourselves to Death: They might sound great, but do stimulus packages work?

This is an article from last month but still has some good points

Barack Obama says his “unprecedented” economic stimulus package will not merely be “a short-term program to boost employment.” No, it “will invest in our most important priorities like energy and education; health care; and a new infrastructure that are necessary to keep us strong and competitive in the 21st century.”

The massive cost of the stimulus doubled even before any legislation was written, much less approved. Originally tagged at $400 billion, the proposal quickly jumped to $825 billion, and latest estimates at press time have it costing north of $1 trillion (comprised of 60 percent spending and 40 percent tax cuts).

Given the size, will the stimulus work as advertised? Will the goods and services—be they concrete for new highway projects or groceries for hungry families—pump up flagging demand and boost stalled economic activity? If so, it will be the first time in modern recorded history.

Take the New Deal. According to the economists Christina Romer—chair of Obama’s Council of Economic Advisers—and David Romer, New Deal spending did not pull the economy out of recession. In a 1992 Journal of Economic History paper, the Romers examined the role that aggregate demand stimulus played in ending the Great Depression. They concluded: “A simple calculation indicates that nearly all of the observed recovery of the U.S. economy prior to 1942 was due to monetary expansion. Huge gold inflows in the mid- and late-1930s swelled the U.S. money stock and appear to have stimulated the economy by lowering real interest rates and encouraging investment spending and purchases of durable goods.”

Even the massive spending during World War II, long touted as pulling America out of the Depression, didn’t necessarily help. In a 2006 paper for the National Bureau of Economic Research, the economists Joseph Cullen and Price V. Fisher asked whether the local economies that were the biggest beneficiaries of federal spending on military mobilization during World War II experienced more rapid growth in consumer economic activity than others. Their finding: Military spending had virtually no effect on consumption.

Another economist, Robert Higgs, offered an even more thoroughgoing critique in an excellent 1992 Journal of Economic History paper. After challenging the conventional portrayal of economic performance during the 1940s, Higgs concluded that “the war itself did not get the economy out of the Depression. The economy produced neither a ‘carnival of consumption’ nor an investment boom, however successfully it overwhelmed the nation’s enemies with bombs, shells, and bullets.” Breaking windows in France and Germany didn’t bring prosperity in America.

In his 2008 book Macroeconomics: A Modern Approach, Harvard economist Robert Barro shows that $1 of government spending in wartime produces less than $1 in GDP—80 cents, to be exact. Stanford economist Bob Hall and Sand Hill Econometrics chief Susan Woodward, neither particularly pro-market, argued recently that each dollar of government spending during World War II and the Korean War produced about $1 of GDP. In other words, the economy is not stimulated by war spending.

The example of 1990s Japan, with its collapsed housing and stock markets, is also relevant. Between 1992 and 1999, Japan passed eight stimulus packages totaling roughly $840 billion in today’s dollars. During that time, the debt-to-GDP ratio skyrocketed, the country was rocked by massive corruption scandals, and the economy never did recover. All Japan had to show for it was some public works projects and a mountain of debt.

Finally, the Bush administration passed the Tax Relief Act of 2001 and the Economic Stimulus Act of 2008, two similar packages with similar effects on the economy. Which is to say, not much. In 2008 the major component was sending $100 billion in cash to Americans so they would have more to spend and thus jumpstart the economy. It failed. People spent little if anything of the temporary rebate, and consumption did not recover....

The theory of economic stimuli suffers from several serious problems. First, it assumes people are stupid. Tax rebates, for example, presume that if people get some money to increase their consumption, businesses will expand their production and hire more workers. Not true. Even if producers notice an upward blip in sales after the rebate checks go out, they will know it’s temporary. Companies won’t hire more employees or build new factories in response to a temporary increase in sales. Those who do will go out of business....

The biggest problem is that the government can’t inject money into the economy without first taking money out of the economy. Where does the government get that money? It can a) borrow it or b) collect it from taxes. There is no aggregate increase in demand. Government borrowing and spending doesn’t boost national income or standard of living; it merely redistributes it. The pie is sliced differently, but it’s not any bigger. In fact, the data suggest that stimuli often end up shrinking the pie....

If politicians actually want to do something cost-effective to solve our economic woes, here’s some advice: Stay away from spending and tax rebates. Instead, focus on real incentives to work and invest, such as cutting marginal tax rates for everyone.

More HERE

***********************

ELSEWHERE

A great video for bird lovers here

Airline mechanics who can't read English: "News 8 has recently revealed serious flaws in the way the FAA licenses mechanics who fix planes. There is evidence of years of problems in testing these mechanics. There is also evidence that hundreds of mechanics with questionable licenses are working on aircraft in Texas. Now there is evidence of repair facilities hiring low-wage mechanics who can't read English. Twenty-one people were killed when U.S. Airways Express Flight 5481 crashed in Charlotte, North Carolina in 2003. The plane went wildly out of control on takeoff. One reason for the crash, investigators found, was that mechanics incorrectly connected the cables to some of the plane's control surfaces in the repair shop. The FAA was cited for improper oversight of the repair process. Repairing airplanes is a complicated business. Airplanes have many manuals. Typically, when mechanics repair a part, they open the manual, consult the book, and make the repair step-by-step, as if it were a recipe book. They make a list of every action they take, so the next person to fix the plane (as well as the people who fly it) will know exactly what has been done. If mechanics don't speak English, the international language of aviation, they can't read the manual and they can't record their activities. There are more than 236 FAA-certified aircraft repair stations in Texas, according to the FAA's Web site. News 8 has learned that hundreds of the mechanics working in those shops do not speak English and are unable to read repair manuals for today's sophisticated aircraft."

Obama's Green car industry: "So far, the Obama administration has yet to lay out its magical thinking on how the homegrown auto makers are to become 'viable' when required to subordinate every auto attribute that consumers find desirable in favor of achieving a passenger-car average of 39 miles per gallon by 2016. Nonetheless the answer has quietly seeped out: Taxpayers will write $5,000 or $7,000 rebate checks to other taxpayers to bribe them to buy hybrids and plug-ins at a price that lets Detroit claim it's earning a 'profit' on its Obamamobiles."

Beer tax on tap for health care? : “Consumers in the United States may have to hand over nearly $2 more for a case of beer to help provide health insurance for all. Details of the proposed beer tax are described in a Senate Finance Committee document that will be used to brief lawmakers Wednesday at a closed-door meeting. Taxes on wine and hard liquor would also go up. And there might be a new tax on soda and other sugary drinks blamed for contributing to obesity. No taxes on diet drinks, however.”

FEC dismisses case against Wal-Mart: “The Federal Election Commission has dismissed a complaint by labor groups accusing Wal-Mart Stores Inc. of unlawfully pressuring employees to vote against Democrats in the November election. FEC commissioners found no evidence to support claims that Wal-Mart broke election law by telling employees that Democrats such as Barack Obama would support a bill to make it easier for workers to unionize.”

The return of the God King: “Most of human history is riddled with misery, poverty and slavery, save a few bright episodes that brought us great benefits, but were ultimately swallowed up by the darkness again. What was it that changed that created those bright spots? There is a simple answer, freedom. Free societies always produce more than centrally controlled ones do. The creative output increases because human energy is allowed to flow and technology is generated from the experimentation that comes with being unfettered. Without exception this is the cycle of mankind, a free people produce great wealth, not just in commodity, but intellectual wealth as well and then the pendulum swings, there is a backlash against the rising tide of equality that freedom encourages.”

The virtuous path to African development: "A source of great frustration to those concerned with world poverty is the relative stagnation of much of the African continent. It is frustrating because we know that widespread poverty is a function of human limitations, not the availability of natural resources. This fact renders less helpful than it might be the guidelines recently released under the title, Natural Resource Charter. Designed by an independent group of economists, lawyers and political scientists to help developing countries manage their natural resources in ways that create real economic growth, the Charter provides helpful insights. Unfortunately, it does not emphasize enough the crucial role of social mores beyond economics and political governance.”

For more postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, GUN WATCH, SOCIALIZED MEDICINE, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS, IMMIGRATION WATCH INTERNATIONAL, EYE ON BRITAIN and Paralipomena

List of backup or "mirror" sites here or here -- for readers in China or for everyone when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here or here or here

****************************

The Big Lie of the late 20th century was that Nazism was Rightist. It was in fact typical of the Leftism of its day. It was only to the Right of Stalin's Communism. The very word "Nazi" is a German abbreviation for "National Socialist" (Nationalsozialist) and the full name of Hitler's political party (translated) was "The National Socialist German Workers' Party" (In German: Nationalsozialistische Deutsche Arbeiterpartei)

****************************

Friday, May 22, 2009

Subscribe to:

Post Comments (Atom)

It's the shared hatred of the rest of us that unites Islamists and the Left.

It's the shared hatred of the rest of us that unites Islamists and the Left.

Eugenio Pacelli, a righteous Gentile, a true man of God and a brilliant Pope

Eugenio Pacelli, a righteous Gentile, a true man of God and a brilliant Pope

No comments:

Post a Comment