In their usual projective way, Leftist psychologists, sociologists etc. have been trying for over 50 years to portray conservatives as mentally ill in some way. The article below refers to the latest such attempt. I have myself written at great length in the academic journals on claims of this sort (e.g. here and here) but the article below does such a good job of ridiculing the Leftist jerk-offs concerned that I will say no more

Last weekend, Harvard University sponsored a conference called (I am not making this up) "The Free Market Mindset: History, Psychology, and Consequences." Its purpose was to try to figure out why, since everyone knows the current crisis amounts to a failure of the market economy, the stupid rubes continue to believe in it. The promotional literature for the conference opened with That Quotation from Alan Greenspan - the one in which he suggested that there was, after all, a "flaw" in the free market he hadn't noticed before.

Well, that does it, then! If our Soviet commissar in charge of money and interest rates says the free market doesn't work, who are you to disagree? The promotional material continues:

If the current state of the U.S. economy makes clear that former Federal Reserve Chairman Alan Greenspan's faith in free markets was misplaced, the question remains: what was it about free markets that proved - and still continues to prove - so alluring to economists, scholars, and policy-makers alike?

Because, of course, if there's one guiding principle behind the largest government in world history, it's free markets. Ahem. This conference, we were told,

brings together leading scholars in law, economics, social psychology, and social cognition to present and discuss their research regarding the historical origins, psychological antecedents, and policy consequences of the free market mindset. Their work illustrates that the magic of the marketplace is partially an illusion based on faulty assumptions and outmoded approaches.

The speakers then spent the day, I am sure, laying out their own faulty assumptions and outmoded approaches, and studiously ignoring the Austrian School of economics.

In short, the conference was about this: Why do people still think the interaction of free individuals is a superior economic system to one directed by Harvard Ph.D.s like us? I mean, apart from the failure of central planning in every case in which it's been tried, a failure so staggering that only a blockhead could miss it, why would people cling to the idea that being herded into a collective run by the experts isn't the best way to live?

So by assuming from the outset the very thing that needs to be proven - namely, that the current state of the economy just occurred spontaneously, as the result of wicked market forces - our betters relieve themselves of the need to consider that central banking, a government-established institution, just might have had, you know, a little something to do with what happened.

George Reisman has already demonstrated the absurdity of referring to our present system as a "free-market" one. Naturally, of course, none of the participants bothered to notice that a Soviet commissar in charge of money and interest rates amounts to something like the opposite of the free market, or that the economic distortions he causes cannot, therefore, be the fault of the free market. This is exactly why, in my book Meltdown, I call the Fed "the elephant in the living room." We're not supposed to notice it, and we're supposed to pretend the damage it causes is the result of wildcat capitalism, unfettered free markets, or whatever other juvenile phrase is currently in vogue to describe the usual bogeyman.

Now I don't want to list all the paper topics at this conference, since it'd be a shame to make all of you feel stupid for having frittered away your weekend when you could have listened to, say, Stephen Marglin's paper on "How Thinking Like an Economist Undermines Community." Now there's a topic I haven't heard quite enough platitudes about. (If you must, you can view the whole schedule here.) You could also have heard a bunch of totally conventional polemics about how the market economy allows for "too much" pollution, when in fact a genuine free market - which, I need hardly point out, is not actually considered in any of these alleged papers - would punish polluters and bring about the internalization of so-called externalities. Murray Rothbard dealt with this matter in an extremely important article none of the participants had read.

I wonder if anyone at the conference asked questions like these:

* When Greenspan flooded the economy with newly created money and brought interest rates down to destructively low levels, thereby distorting entrepreneurial calculation as well as consumers' home-purchasing decisions, was that the fault of the free market?

* Do you think the Fed's creation of cheap credit out of thin air makes market participants more careful or less careful in how they allocate borrowed funds?

* When Alan Greenspan bailed out Long Term Capital Management in 1998, was that a "free market" phenomenon? Do you think he thereby encouraged more or less risk taking among other major market actors?

* The Financial Times spoke in 2000, in the wake of the dot-com boom, of an increasing concern that the so-called "Greenspan put" was injecting into the economy "a destructive tendency toward excessively risky investment supported by hopes that the Fed will help if things go bad." "All the insane dot-com investment we've seen, all this destruction of capital, all the crazy excesses of the past few years wouldn't have happened without the easy credit accommodated by the Fed," added financial consultant Michael Belkin. Did the free market cause that?

* Do lending standards decline for no particular reason, or could this phenomenon have a teensy weensy bit to do with (a) government regulation aimed at increasing "homeownership" and (b) loose monetary policy by the Fed? (When the banks get the additional reserves the Fed creates, they naturally want to lend it out - and in order to do so, they wind up lending it to people they either have or would have rejected previously. As I show in Meltdown, the phenomenon of lax lending standards in the wake of an inflationary boom by a central bank is traceable all the way to the 19th century. There is nothing even slightly unexpected - or market-driven - about it.)

Questions like these could go on and on. Not one, you can be certain, was raised at this conference.

Now if you really wanted to sponsor an event whose purpose was to try to understand why people believe inane things that have been falsified by reality, you'd do much better to hold a conference on socialism, or on Keynes and his school. It would be fascinating to learn the psychological motivation behind the persistence of Keynesian economics, whose popular version is a nonfalsifiable, ersatz religion....

People who believe in the market economy support a social order in which free individuals make voluntary contracts with each other, and no one can initiate physical force against anyone else. Is that vision so obviously unattractive that we have to refer its supporters for psychological evaluation?

We might instead wonder at the psychological condition of those who would denounce such a system: might they be motivated, for all their noble talk, by nothing but base envy of those with more material wealth than they, or by a pathological desire to dominate other people? I'm sure that will be covered at next year's conference.

More here

***************************

IN THE BEGINNING.... JUST TO JOG YOUR MEMORY ABOUT WHO PROMOTED JUNK HOME LOANS

It wasn't "capitalism" or the "free market". Fannie Mae is a Federal government instrumentality. The article below by STEVEN A. HOLMES appeared in the New York Times: Thursday, September 30, 1999

Fannie Mae Eases Credit To Aid Mortgage Lending

In a move that could help increase home ownership rates among minorities and low-income consumers, the Fannie Mae Corporation is easing the credit requirements on loans that it will purchase from banks and other lenders. The action, which will begin as a pilot program involving 24 banks in 15 markets -- including the New York metropolitan region -- will encourage those banks to extend home mortgages to individuals whose credit is generally not good enough to qualify for conventional loans. Fannie Mae officials say they hope to make it a nationwide program by next spring.

Fannie Mae, the nation's biggest underwriter of home mortgages, has been under increasing pressure from the Clinton Administration to expand mortgage loans among low and moderate income people and felt pressure from stock holders to maintain its phenomenal growth in profits. In addition, banks, thrift institutions and mortgage companies have been pressing Fannie Mae to help them make more loans to so-called subprime borrowers. These borrowers whose incomes, credit ratings and savings are not good enough to qualify for conventional loans, can only get loans from finance companies that charge much higher interest rates -- anywhere from three to four percentage points higher than conventional loans.

''Fannie Mae has expanded home ownership for millions of families in the 1990's by reducing down payment requirements,'' said Franklin D. Raines, Fannie Mae's chairman and chief executive officer. ''Yet there remain too many borrowers whose credit is just a notch below what our underwriting has required who have been relegated to paying significantly higher mortgage rates in the so-called subprime market.'' Demographic information on these borrowers is sketchy. But at least one study indicates that 18 percent of the loans in the subprime market went to black borrowers, compared to 5 per cent of loans in the conventional loan market.

In moving, even tentatively, into this new area of lending, Fannie Mae is taking on significantly more risk, which may not pose any difficulties during flush economic times. But the government-subsidized corporation may run into trouble in an economic downturn, prompting a government rescue similar to that of the savings and loan industry in the 1980's. ''From the perspective of many people, including me, this is another thrift industry growing up around us,'' said Peter Wallison a resident fellow at the American Enterprise Institute. ''If they fail, the government will have to step up and bail them out the way it stepped up and bailed out the thrift industry.''

Under Fannie Mae's pilot program, consumers who qualify can secure a mortgage with an interest rate one percentage point above that of a conventional, 30-year fixed rate mortgage of less than $240,000 -- a rate that currently averages about 7.76 per cent. If the borrower makes his or her monthly payments on time for two years, the one percentage point premium is dropped.

Fannie Mae, the nation's biggest underwriter of home mortgages, does not lend money directly to consumers. Instead, it purchases loans that banks make on what is called the secondary market. By expanding the type of loans that it will buy, Fannie Mae is hoping to spur banks to make more loans to people with less-than-stellar credit ratings.

Fannie Mae officials stress that the new mortgages will be extended to all potential borrowers who can qualify for a mortgage. But they add that the move is intended in part to increase the number of minority and low income home owners who tend to have worse credit ratings than non-Hispanic whites.

Home ownership has, in fact, exploded among minorities during the economic boom of the 1990's. The number of mortgages extended to Hispanic applicants jumped by 87.2 per cent from 1993 to 1998, according to Harvard University's Joint Center for Housing Studies. During that same period the number of African Americans who got mortgages to buy a home increased by 71.9 per cent and the number of Asian Americans by 46.3 per cent. In contrast, the number of non-Hispanic whites who received loans for homes increased by 31.2 per cent.

Despite these gains, home ownership rates for minorities continue to lag behind non-Hispanic whites, in part because blacks and Hispanics in particular tend to have on average worse credit ratings.

In July, the Department of Housing and Urban Development proposed that by the year 2001, 50 percent of Fannie Mae's and Freddie Mac's portfolio be made up of loans to low and moderate-income borrowers. Last year, 44 percent of the loans Fannie Mae purchased were from these groups.

The change in policy also comes at the same time that HUD is investigating allegations of racial discrimination in the automated underwriting systems used by Fannie Mae and Freddie Mac to determine the credit-worthiness of credit applicants.

SOURCE

**************************

ELSEWHERE

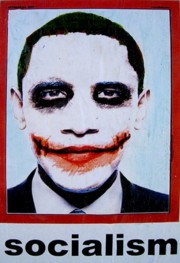

Obama's road to Fascism: ""President Obama is taking over production in the American economy. President Bush admitted to doing the same with the banking, real estate and insurance industry bailouts, proclaiming he `abandoned the free market to save the free market.' Besides being oxymoronic, he was admitting he moved from a system where people control production (capitalism) to a planned economy where government controls production (there are three main types of planned economies - fascism, socialism and communism). While refusing to similarly label his own actions, President Obama at least admits he is following what President Bush did first. I have been arguing since November that the type of planned economy we are moving toward is most like fascism, not socialism."

The NYT version of a "moderate": "Barack Obama has selected a leftist, David Hamilton, to be his first nominee for the federal bench. Hamilton is Obama's nominee for a spot on the Seventh CIrcuit Court of Appeals. Appropriately enough, Hamilton reportedly was once a former fund-raiser for the radical activist outfit ACORN, a key Obama ally. He is also a former leader of the Indiana chapter of the ACLU. Hamilton's record as a federal district judge confirms his ultra-liberalism. Recently, he invalidated a law requiring the registration of sex offenders. He also prevented enforcement of an Indiana law that required information and a waiting period before an abortion. The Seventh Circuit (the court to which Hamilton now has been nominated) found that the law in question was materially identical to a law upheld by the U.S. Supreme Court in the Casey decision. It noted that no judge in the land, other than Hamilton, has found such a law invalid since Casey was decided"

More destructive Obama-ism: It seems that not all forms of recycling are to be embraced. In a move that will greatly increase the cost of ammunition and may cause several US manufacturers to lay off workers, the Defense Department is ending a long standing practice of selling expended brass cartridges to domestic ammunition manufacturers. Instead the readily recyclable casings are to be melted down and recast for sale as scrap metal. To add insult to injury it should be noted that a scrap metal the brass will sell for substantially less than the expended casings themselves now bring!"

Israel: Netanyahu may become PM, finance minister: "Benjamin Netanyahu may take the finance minister's job himself when he becomes Israeli prime minister and forms the next government, a source close to the right-wing leader said on Tuesday. Netanyahu, facing the difficult issues of national security and the flagging economy, is in the process of forming a governing coalition after the February 10 parliamentary election. The source said Netanyahu, whose free market policies won praise from investors during his 2003-2005 tenure as finance minister, is weighing up whether to hold the post himself again or hand the job to a businessman with no political ties."

British Big Brother is watching: "The travel plans and personal details of every holidaymaker, business traveller and day-tripper who leaves Britain are to be tracked by the Government, the Daily Telegraph can disclose. Anyone departing the UK by land, sea or air will have their trip recorded and stored on a database for a decade. Passengers leaving every international sea port, station or airport will have to supply detailed personal information as well as their travel plans. So-called "booze crusiers" who cross the Channel for a couple of hours to stock up on wine, beer and cigarettes will be subject to the rules. In addition, weekend sailors and sea fishermen will be caught by the system if they plan to travel to another country - or face the possibility of criminal prosecution."

For more postings from me, see TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, GUN WATCH, SOCIALIZED MEDICINE, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS, IMMIGRATION WATCH INTERNATIONAL, EYE ON BRITAIN and Paralipomena

List of backup or "mirror" sites here or here -- for readers in China or for everyone when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here or here or here

****************************

The Big Lie of the late 20th century was that Nazism was Rightist. It was in fact typical of the Leftism of its day. It was only to the Right of Stalin's Communism. The very word "Nazi" is a German abbreviation for "National Socialist" (Nationalsozialist) and the full name of Hitler's political party (translated) was "The National Socialist German Workers' Party" (In German: Nationalsozialistische Deutsche Arbeiterpartei)

****************************

It's the shared hatred of the rest of us that unites Islamists and the Left.

It's the shared hatred of the rest of us that unites Islamists and the Left.

Eugenio Pacelli, a righteous Gentile, a true man of God and a brilliant Pope

Eugenio Pacelli, a righteous Gentile, a true man of God and a brilliant Pope

No comments:

Post a Comment