By Steven E. Landsburg, a professor of economics at the University of Rochester in Rochester, New York

We are embarking on the most radical transformation of the American economy since the New Deal, committing hundreds of billions in taxpayer money to save banks and other financial institutions from the consequences of their own bad investments. This, we are told, is the cost of averting a crisis. But I sure wish someone would explain to me exactly what crisis we're trying to avert.

What's clear is that a bunch of financial institutions have made mistakes and lost money. What's unclear is why anyone (other than the owners and managers) should care. People make mistakes and lose money all the time. Restaurants fail, grocery stores fail, gas stations fail. People pick the wrong stocks, they buy the wrong cars, and they marry the wrong spouses without turning to the Treasury for bailouts.

So what's special about banks? According to what I keep reading, it's that without banks, nobody can borrow, and the economy grinds to a halt. Well, let's think about that. Banks don't lend their own money; they lend other people's (their depositors' and their stockholders'). Just because the banks disappear doesn't mean the lenders will. Borrowers will still want to borrow and lenders will still want to lend. The only question is whether they'll be able to find each other.

That's one reason I feel squeamish about the official pronouncements we've been getting. They tell us bank failures will make it hard to borrow but never that bank failures will make it hard to lend. But every borrower is paired with a lender, so it's odd to state the problem so asymmetrically. This makes me suspect that the official pronouncers have not entirely thought this thing through.

In the 1930s, a wave of bank failures did make it hard for borrowers and lenders to find each other, and the consequences were drastic. But times have changed in at least two relevant ways. First, the disaster of the 1930s was caused not just by bank failures, but by a 30% contraction of the money supply, which is something today's Fed can easily prevent. Second, as any user of match.com can tell you, the technology for finding partners has improved since then. When a firm wants to raise capital, why can't it just sell bonds over the web? Or issue new stock? Or approach one of the hedge funds that seem to be swimming in cash? Or borrow abroad?

I know, I know, the rest of the world is in crisis too. But surely in the vast global economy, it should be possible to find someone capable of introducing a lender to a borrower. (Note that I'm not talking about going to foreign lenders, though that's another option. I'm just talking about the same American borrower and American lender who would have found each other through Bear Stearns finding each other through Barclays instead.)

In other words, I'm not sure these big Wall Street banks are really necessary, and I'm not sure we'd miss them much if they were gone. Maybe there's something I'm missing, but if so, I think it should be incumbent on Messrs. Bernanke, Paulson and above all Bush to explain what it is.

Source

**************************

ELSEWHERE

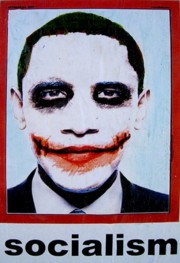

Bailout marks Karl Marx's comeback : "In his Communist Manifesto, published in 1848, Karl Marx proposed 10 measures to be implemented after the proletariat takes power, with the aim of centralizing all instruments of production in the hands of the state. Proposal Number Five was to bring about the `centralization of credit in the banks of the state, by means of a national bank with state capital and an exclusive monopoly.' If he were to rise from the dead today, Marx might be delighted to discover that most economists and financial commentators, including many who claim to favor the free market, agree with him."

Why I oppose the bailout, by US Rep. Mike Pence (R-IN): "Economic freedom means the freedom to succeed and the freedom to fail. The decision to give the federal government the ability to nationalize almost every bad mortgage in America interrupts this basic truth of our free market economy. Republicans improved this bill but it remains the largest corporate bailout in American history, forever changes the relationship between government and the financial sector, and passes the cost along to the American people. I cannot support it."

A damn good defeat: "There is no disputing that financial firms have too much unidentified and unpriced, semi-performing assets on their books. To regain access to the credit and capital markets, all these firms have to do is identify and price those assets. The resulting write-downs will trim the share price and capital will once again flow in. It's that simple, kind of. You see, these firms don't just want access to the capital markets again, they want it at the share price they can command with those overvalued assets on their books. Hey, I want $30K for my `92 Accord with 200k miles on it, too, but I'm not holding my breath. The Billionaire Bailout scheme, in a round-about fashion, is to force you to take on these overvalued assets at book value or, in most cases, higher thus replacing ??? with cash on the books of financial firms. When the scheme fell apart this afternoon, the stock market resumed its one-and-only function: discovering the share price at which firms can access capital markets."

Economic laws of conservation: "One of the economic broad principles that I am familiar with is that, while the market can be wrong, you (whoever you are) are almost certainly unable reliably to do better than the market. Claims that the government will probably recoup its investment and even profit violate this principle. Another of the economic broad principles that I am familiar with is that the market works by no other means than rewarding wise investment and punishing foolish investment. That is how it works. A more general broad principle, upon which this relies, is that you get more of what you reward. The bailout violates this principle as well. Miron, and other economists who have spoken out against the bailout, have tended to make arguments that I find comprehensible and persuasive, because they appeal to broad economic principles that I am familiar with and have long since accepted. Those who have spoken out in favor of the bailout - well, for one thing, rather than see actual arguments from them I have seen appeals to authority, appeals to hidden knowledge, sky-is-falling warnings that have no actual content but serve merely to shift the reader into panic mode, vehement attacks on those who disagree, and the like".

If you're going to bailout anybody... : "It is not clear whether there would be a financial catastrophe if the bailout were not passed. Credit is still available; millions of people are still using their credit cards. Businesses are still getting loans. However, it is true that many firms can't obtain funds except at quite high risk premiums, or not at all. The credit markets are somewhat stuck, but maybe that is because lenders are waiting for the government to act. Any plan that bails out banks and mortgages is going to favor some at the expense of others. Many who have been dutifully paying their mortgage payments, or fully own their homes, will not get any aid. If there is a major liquidity problem, and if government has to step in to prevent financial chaos, the egalitarian solution would be to provide money to everyone equally. Money to the people!"

The end of the US financial system as we know it? : "A number of Republican House members and staff, along with others who are plugged in, are telling me that Nancy Pelosi and the Democrats will come back with a new bill that includes all the left-wing stuff that was scrubbed from the bill that was defeated today in the House. . Of course, this scenario will lose more Republican votes. But insiders tell me President Bush will take Secretary Paulson's advice and sign that kind of legislation."

Bush signs sprawling spending bill: "President Bush on Tuesday signed a sprawling, stopgap spending bill to keep the government running for the next 12 months. The president's move, which came on the last day of the government's budget year, was expected even though the measure spends more money and contains more pet projects than he would have liked. The legislation is one of the few bills this election year that simply had to pass. The $630 billion-plus spending bill wraps together a record Pentagon budget with aid for automakers and natural disaster victims, and increased health care funding for veterans returning from Iraq and Afghanistan. The measure also lifts a quarter-century ban on oil drilling off the Atlantic and Pacific coasts, a victory for Bush and fellow Republicans."

UK: We'll protect bank savings: "`Prime Minister Gordon Brown has told the BBC that he will do "whatever it takes" to protect people's savings.Moves to guarantee bank deposits up to 50,000 pounds - compared with the current 35,000 limit - are expected shortly.He declined to offer an unlimited guarantee, as has happened in Ireland, but pointed out the government had not let any UK depositor lose out. .. The Irish government has made an emergency decision to guarantee the safety of all deposits in six of its main savings institutions for two years."

You can trust us with your personal data? "Britain's MI6 intelligence service is investigating how a camera holding sensitive information about al-Qaida suspects came to be lost by one of its agents and then sold on eBay, police said on Tuesday. `We can confirm we seized a camera after a member of the public reported it,' said a statement by police in Hertfordshire, north of London, after the camera was handed into a police station."

For more postings from me, see OBAMA WATCH (2), TONGUE-TIED, EDUCATION WATCH INTERNATIONAL, GREENIE WATCH, POLITICAL CORRECTNESS WATCH, GUN WATCH, SOCIALIZED MEDICINE, FOOD & HEALTH SKEPTIC, AUSTRALIAN POLITICS, IMMIGRATION WATCH INTERNATIONAL, EYE ON BRITAIN and Paralipomena

List of backup or "mirror" sites here or here -- for readers in China or for everyone when blogspot is "down" or failing to update. Email me here (Hotmail address). My Home Pages are here or here or here

****************************

The Big Lie of the late 20th century was that Nazism was Rightist. It was in fact typical of the Leftism of its day. It was only to the Right of Stalin's Communism. The very word "Nazi" is a German abbreviation for "National Socialist" (Nationalsozialist) and the full name of Hitler's political party (translated) was "The National Socialist German Workers' Party" (In German: Nationalsozialistische Deutsche Arbeiterpartei)

****************************

It's the shared hatred of the rest of us that unites Islamists and the Left.

It's the shared hatred of the rest of us that unites Islamists and the Left.

Eugenio Pacelli, a righteous Gentile, a true man of God and a brilliant Pope

Eugenio Pacelli, a righteous Gentile, a true man of God and a brilliant Pope

No comments:

Post a Comment